A financial institution decided to open its next 2000 branches using DS Markets - Why?

In 2022, a 100-year-old bank in India announced its plans to shut down or merge 600 loss-making branches by March 2023. But why? Not just in India, but globally banks are reducing their number of branches. A possible reason could be the huge cost associated with them and banks adopting the digital-first approach.

Many people indeed prefer doing things at their fingertips, but some of them prefer the in-person experience. What should banks do in that case?

How about upgrading the branch opening approach? As a layman, we might simply say that banks open branches by looking at the hustle and bustle of an area or matching toe-to-toe with their competitors. But there’s a lot more that banks consider, especially with data at play today! Answering questions like “Where should I open my next bank branch?” is crucial and can play a pivotal role in the branch’s performance. Let’s understand the data layers that can be added to the branch opening process!

Opening your next branch with a data-powered map!

If a financial institution in India takes up the challenging task of deciding where to open its next 2,000 branches, it must understand the dynamics of the market and make an informed decision.

Let’s imagine a map of India before our eyes and the colors green, yellow, and red as our indicators of the potential that lies in the area. Now, consider these questions:

- Opportunities – How many businesses, individuals, and offices are present?

- Competition – Is there a location where my competitors are present but I am not?

- Product Potential – Which are the top products i.e. gold loan, personal loan, etc. selling in various locations?

- Risk Profile – Are individuals or businesses paying off their loans or debt on time?

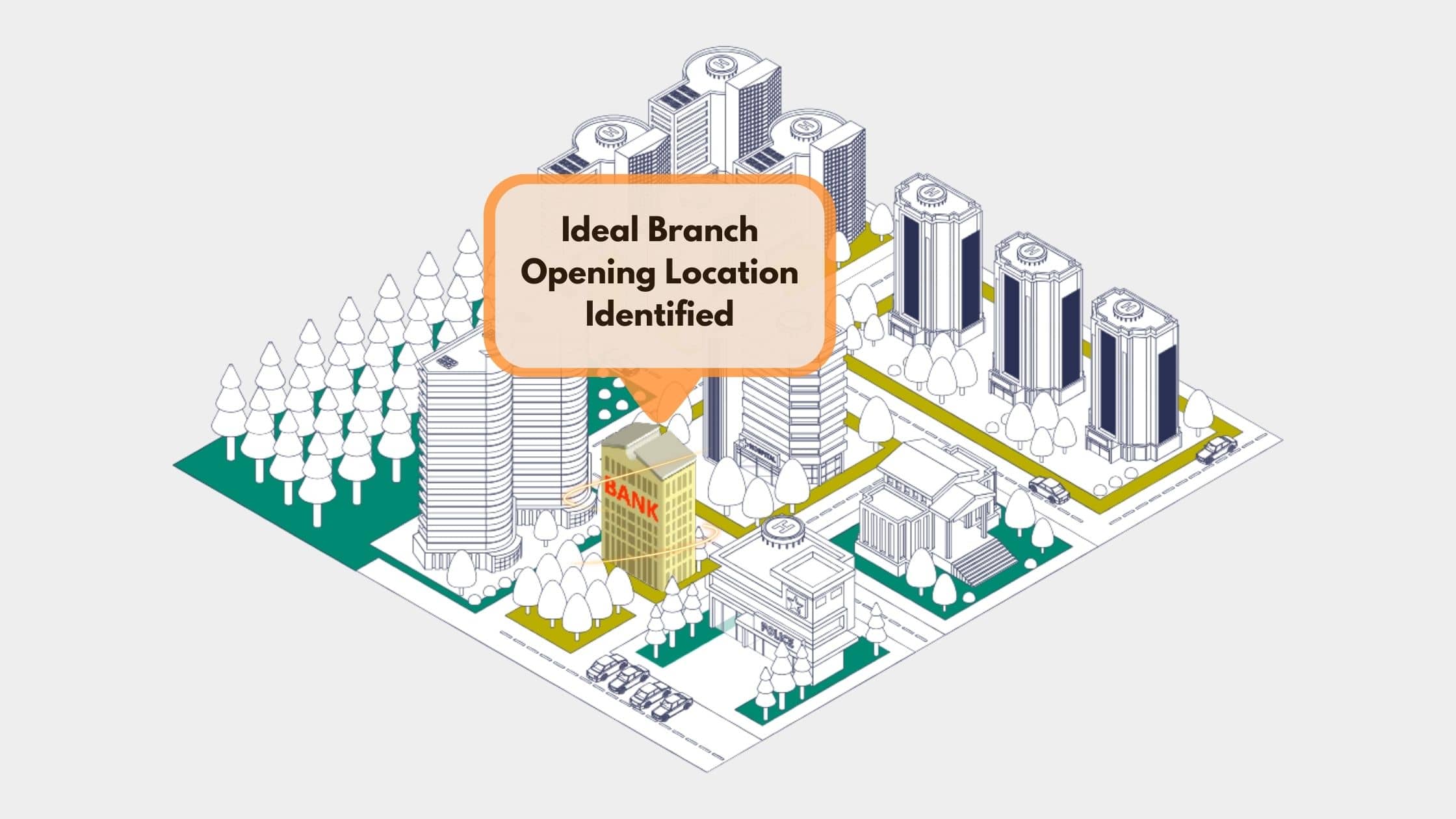

Considering these factors, we can categorize locations into high, medium, and low potential. Financial institutions or banks can then further narrow down their search until they choose an exact location to open their branch.

Out of all the high-potential locations identified in India, we will zoom into one to decide a specific area to open our next branch. Let’s consider Thane as a high-potential location.

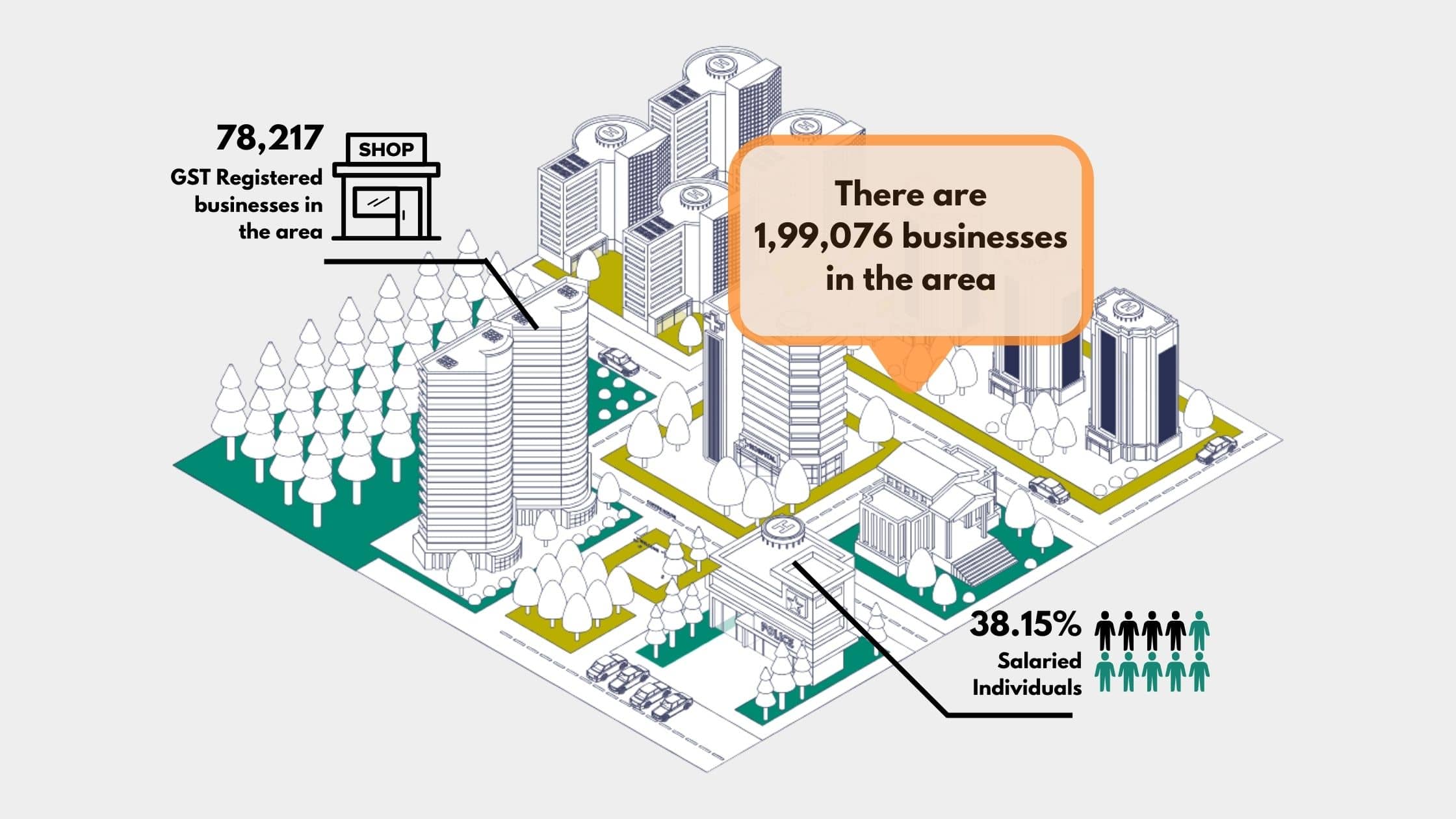

How many businesses and individuals are present?

As someone who wants to open a new bank branch, we would want to know the number of businesses, offices, and individuals present there. This will help us gauge the target audience that we can tap into. We can also sharpen our search by understanding:

- No. of GST and Non – GST registered businesses

- Turnover of businesses

- Type of businesses

- Categories (Clothing stores, General Stores, etc.) and more

Where are my competitors?

Every bank aims to place its branches strategically in any location. Knowing where your competitors’ branches are present is an advantage as every bank does its research before choosing a branch location. Including data in the process can give us additional insights and also help to identify gaps in our presence. We can understand:

- The total number of bank branches

- The market share breakup of banks and more.

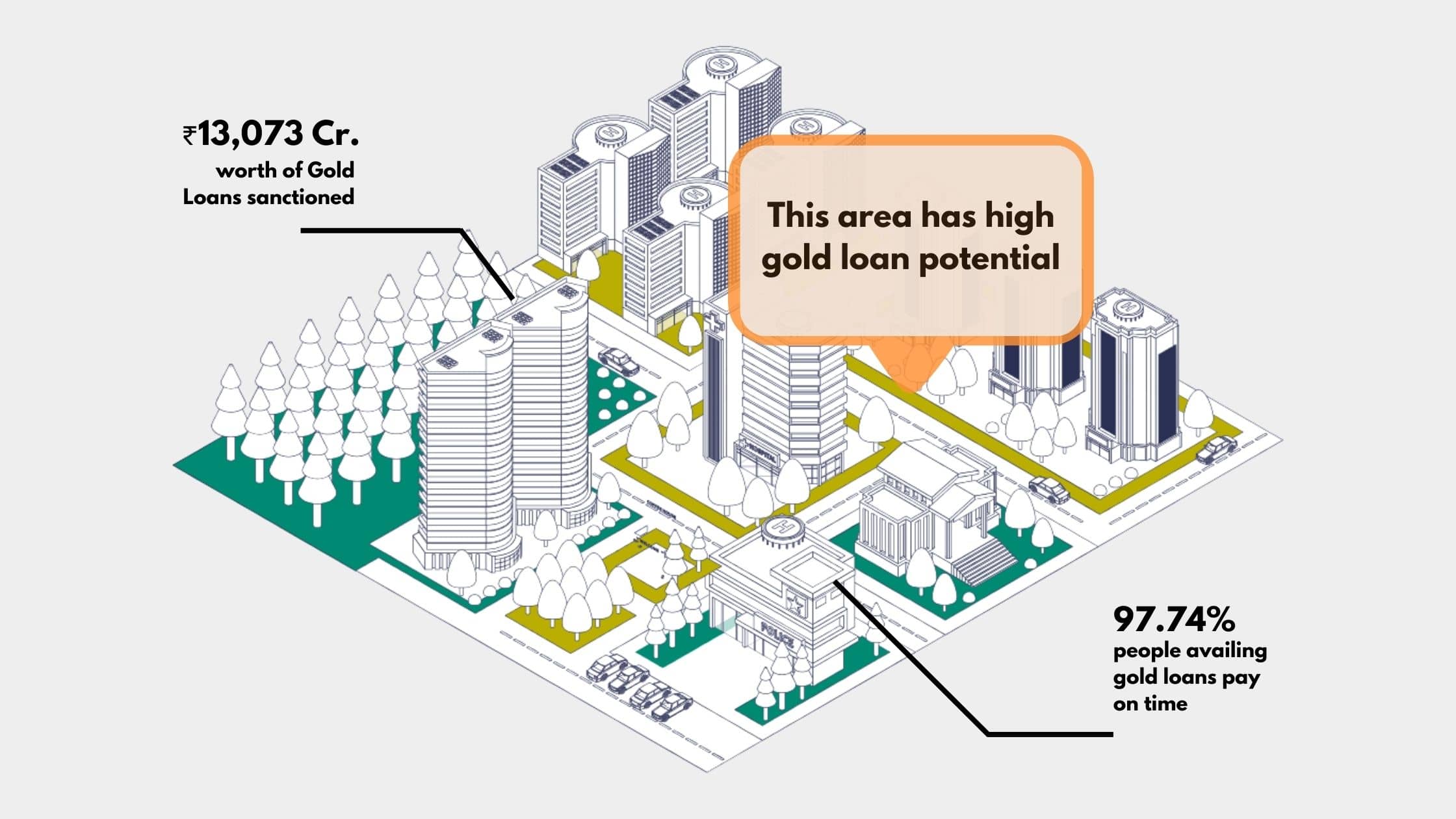

Which are the top products sold in a market?

Suppose in a location, we know the amount of any type of loan disbursed, its count, and its average ticket size. This can help us define which products should the branch focus on. For example, if a location has a high potential for gold loans, the branch opened there can be focused on selling more gold loans.

What is the risk profile of an area?

The risk profile of an area is also an important aspect to consider as it helps us understand whether the individuals and businesses present are repaying their existing loans on time. If the risk profile of an area is high, opening a branch in that location can negatively impact our bank’s business.

When we combine these points, we have a data-backed answer to “Where should I open my next branch?” It not only makes the process efficient but also minimizes the risk so you can leverage the full potential of any location. Be it 2000 or simply 2, we can follow the same process and choose the locations we want to open our branch in.

Does this mean, every bank needs to put in a lot of time, effort, money, and research before opening their next branch? Will there be a room with a team that has a huge map on the wall and colors it as they keep understanding the potential of a location? Well, that will become very tiresome.

DS Markets to the rescue!

DS Markets by Data Sutram can help you do it with a few clicks on your keyboard and visualize the map on your computer screen. You can gain an overview of any location and decide based on your audience. This platform gives you all the necessary answers just by applying specific filters and utilizing the dashboard optimally.

The whole process is made sharper with the help of DS Markets! This is how the Financial Institution could plan and open 2000 branches in a short time and also choose optimal locations for it!

What does a bank need to do to leverage the power of DS Markets? Banks simply need to reach out to Data Sutram and book a demo call! Does that mean now branch opening is at your fingertips? Absolutely!